Recapping 'How Do VCs Value Health Science Companies? From Valuation to Deal Structure'

By Klaus Fiebig, VP Strategic Programs, OBIO

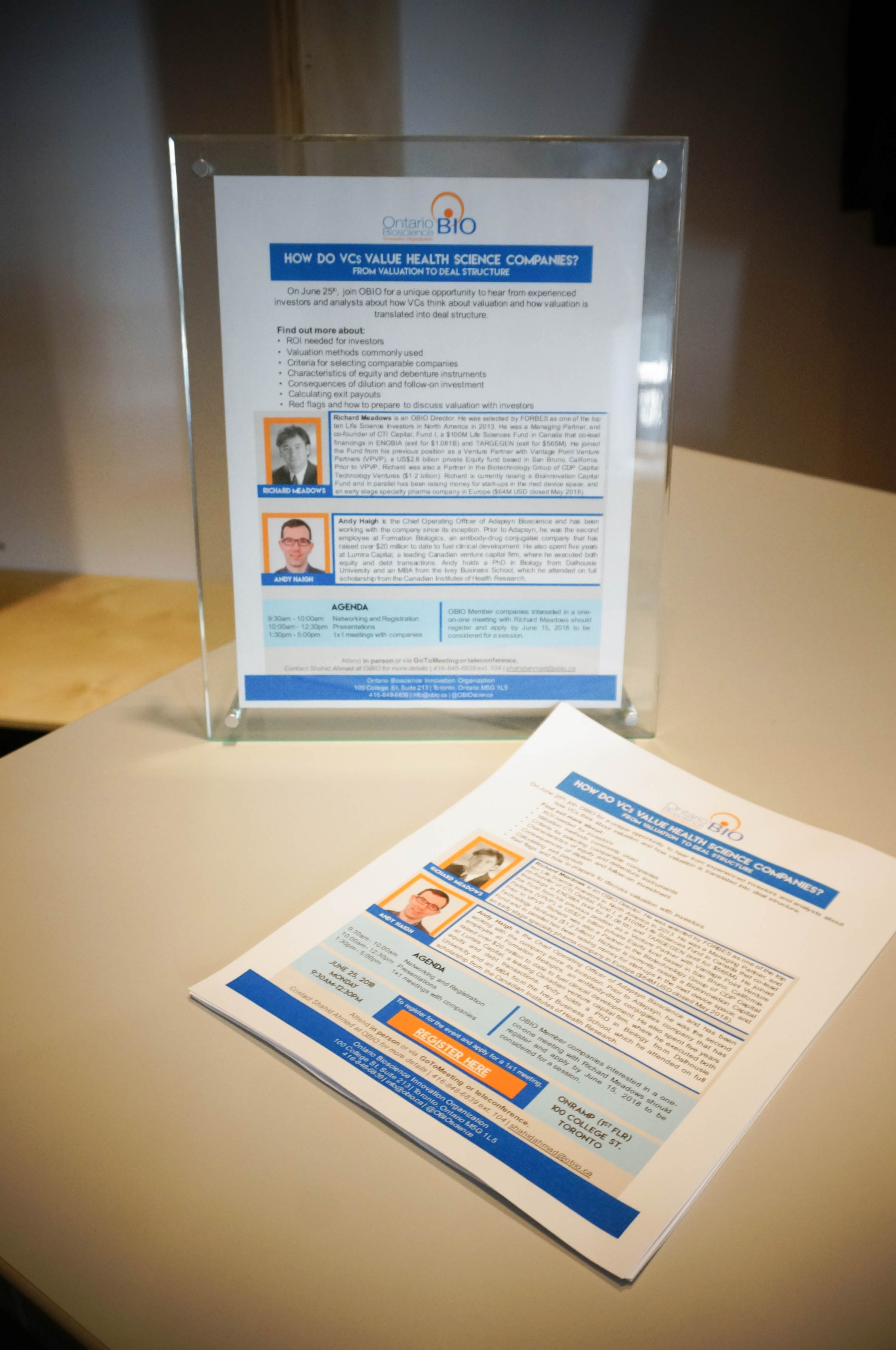

On June 25th, OBIO organized a workshop with two industry leaders and provided a VC perspective on how they valuate start-up companies and on how this is translated into a deal structure.

Richard Meadows (General Partner, BioInnovation Capital Fund & OBIO Board Director) talked about his extensive experience as a venture capitalist and how a VC approaches company valuation while Andy Haigh (COO, Adapsyn Bioscience) gave an overview of different investment vehicles and terms.

Definition of Terms:

Pre-money: the value of a company BEFORE investment - not the money invested to date

Post-money: the value of a company AFTER investment is received; equals pre-money + investment

Return on investment: the increase in value of an investment divided by the cost of the investment; equals terminal value / post-money valuation

Present value: value today - the result of applying a very significant discount rate to the future value of the company

Terminal value: anticipated selling price/exit for a company in the future (liquidity event such as M&A or IPO)

Richard started his presentation by commenting on the three things companies need to say right up front in any VC presentation:

Why you are there

What problem you are solving

What your solution is

Valuation exercise is more art than science with a heavy dose of negotiation thrown in by the investment source. It’s going to be both interesting and painful. That’s why companies should really prepare well in advance. Timing is everything and it is important to get your valuation range right at the very beginning, backed up with data that support such a range. Consider that there are thousands of “sellers” competing for that limited amount of money of your customers, the VCs. Furthermore, choosing the right kind of investor will give the company more added value. When you try to find a VC, you are not merely getting the money itself. It is important to find a VC that is related to your field because they will provide you with guidance, expertise and connections.

Richard continued by discussing valuation mechanics in more detail. He indicated that VCs’ lives revolve around post-money valuation of the company. For pre-money, his opinion is that less is better. It is better for both the company and the investors themselves. This may seem counterintuitive but it’s true, especially in cases where VCs have certain maximum valuation cutoffs needed to justify reviewing the opportunity. This is driven by the need of a VC to obtain a certain return on investment for his limited partners who contributed to the VC’s fund. Richard mentioned that one advantage Canadian companies have over U.S. companies is that for the same stage of development, generally the valuation of a Canadian company is more attractive than for a U.S. company. This is because Canadian valuations tend to be lower than U.S. valuations. But companies should still be realistic when valuing their companies. A good approach is to back calculate your valuation based on recent exits or deals of comparable companies and to develop a financing strategy for the funds needed. In such VC valuation models, the time needed and risks encountered to get to an exit is heavily discounted. Also, fundraising rounds need to be carefully sized and timed so that the raised money can generate the necessary data (e.g. pre-clinical, clinical, manufacturing, market adoption, regulatory, and/or sales data) to justify an increased valuation at the next round of financing. As Richard succinctly pointed out – data equals value. Another issue that can delay, stall, or even kill a deal is an overly complex capitalization table. It’s fully worth to clean things up and model how your cap table will evolve through the different rounds of financings. Here the devil is in the detail as deal terms can have a huge effect.

Andy Haigh’s presentation picked up from Richard’s last point and focused on modelling a company’s capitalization table evolution through several fundraising cycles. He mentioned that deals are very complicated, but the best deals get done when everybody knows what they are talking about. If the company does not understand what the deal terms mean in terms of their cap table it will be difficult for them to negotiate. Andy reiterated that one needs to figure out how much money a company will really need and work backwards from a likely exit to get the current valuation. Key input parameters to consider in that process are time and money needed to get to an exit, which gets broken into different funding rounds.

Return on investment needed is directly correlated to risk. VCs will insist on levers to ensure ROI demanded by their LPs. For seed investments, an ROI of 6 to 10x is typical. For later rounds, the ROI to justify an investment is less (Series A = 7x, Series B = 5x, Series C = 3x). Also, valuation is not static, and it critically depends on data generated to support value inflections and money already raised. Using his own proprietary tool, PrefStack, Andy demonstrated the consequences of different fundraising and capitalization strategies and terms on share value and ownership.

To access the complete webinar for OBIO’s “How Do VCs Value Health Science Companies? From Valuation to Deal Structure”, please visit the OBIO Member Portal where it will uploaded shortly – click here.

If you aren’t already an OBIO Member, find out how to sign up today - click here.