On February 26th, OBIO hosted Jasmin Ganie-Hobbs (Director Tech Finance, BDC) and Antonio Lopes (Global Accounts Director, EDC) who spoke about ‘How BDC and EDC Can Help Your Business.’

While many of us in the health science industry are aware of BDC and EDC, we learned that there is a lot more that they can do help your business than you probably know. While both organizations are focused on helping companies once they have sales, we learned that you should engage with BDC during your first year of sales and start talking to EDC at least 2 to 3 months before you expect to sign your first contract to sell outside of Canada.

The Business Development Bank of Canada (BDC) will provide loans for any legitimate business activity, including R&D activities and IP costs, earlier or in higher risk situations than traditional chartered banks. For example, they can provide loans to companies who are obtaining revenue from pilots and do not yet have any recurring revenue. They are also able to develop highly customized loans, which may include initial interest-only payment periods and are open to restructuring of payments if your financial situation changes.

Jasmin indicated BDC will need to review your business plan and financial projections (check out OBIO Member Resources for examples of business plan templates), financial statements and copies of any contracts or letters of intent so they can assess the team, technology and business model when making a decision on providing a loan. Once they have done an initial review, but before conducting more onerous due diligence, they will provide you with a term sheet indicating how much they would be willing to loan and at what interest rates and any fees, allowing you to decided if you want to move forward early in the process before you have to devote large amounts of time to the process.

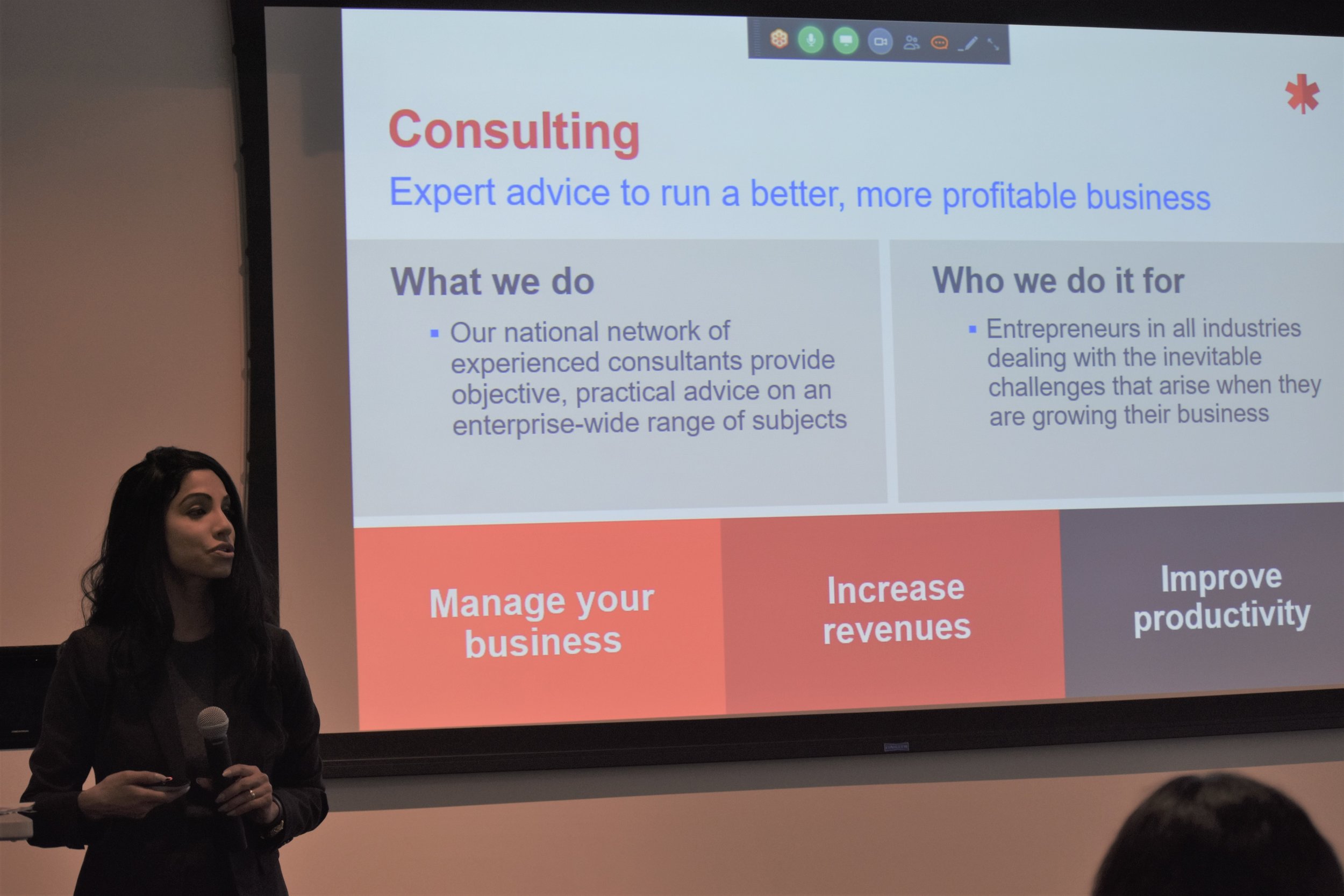

Beyond providing business loans, BDC also provides free resources through their website including some online courses on financing and marketing, financial tools and various templates. They also provide paid advisory services provided by consultants. Jasmin noted that smaller companies tended to use the HR, Sales & Marketing and the financial paid advisory services most commonly.

Export Development Canada (EDC) provides solutions to mitigate risk when selling outside of Canada. One of the main products EDC offers are insurance solutions including Credit Insurance and Political Insurance.

Credit insurance protects from non-payment due to default or bankruptcy and allows you to offer payment terms to your customers, while political insurance protects against expropriation, political violence or non-payment by a government. A second set of solutions relate to providing guarantees to your bank when they are required to provide financial letters of guarantee or standby letters of credit. For example: you have a contract with a new foreign customer, but one of your foreign vendors says “I don’t know you well enough to agree to doing the manufacturing without a letter of credit” but your bank is reluctant to issue the letter of credit because you don’t have the assets to secure the LC. This is where you can engage EDC to help. The third way EDC can help is by providing financing solutions (usually through loan guarantees to your bank) to support you export needs such as providing pre-shipment or work in process financing, or an operating line of credit which to allows you to manage cashflow when exporting.

EDC also offers advisory services (all for free) including webinars and online courses related to global trade as well as market information, information on potential global partners.

To understand more about how BDC and EDC can help you grow your business, check out the slides and recording of the workshops on the OBIO Member Portal.